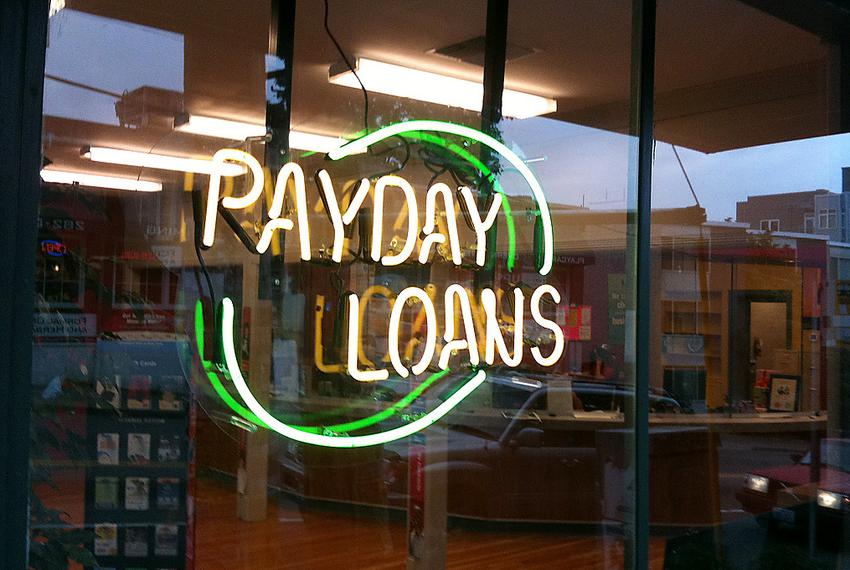

A payday loan is a celebrated form of short-term financing suitable for unplanned emergencies. The repayment format that these loans follow makes them a more convenient option. They are easily payable after the receipt of the next month’s salary.

Therefore, you can bid adieu to any unforeseen necessity occurring between paydays. The best part is that you can pay them back once your salary credits. Thus, the chances of missing out on payments are mild and can happen if you are less careful about your finances.

These loans seem to have the perfect recipe for overcoming the financial crisis. Do you have any dilemma regarding the requirements? Then, you must know that getting a payday loan facing no credit check from a direct lender is possible for you.

It is because this is an income-based financing option. Here, your salary can provide the strongest assurance for loan payment. For this reason, the lender does not feel the need to validate your credit scores.

In the case of these loans, facing any hard credit verification is not necessary. However, the lender will try to make sure about the successful chances of repayment through other ways.

Do not think that you now know everything about these loans. You are yet to explore other scenarios when these loans might not work for you. Enlighten yourself about the reality of these loans by digging through this blog.

Are payday loans a better alternative?

Are you re-iterating this question in your mind? Every borrower does the same thing, and it is a good practice. Whether you borrow money for a small or big purpose does not matter.

Having this clarity in mind is pivotal, or else you might end up with a wrong decision. Find a guide below that discloses a lot about these loans.

Does a payday loan work the typical way?

The reach of payday loans is now quite restricted as not many lenders are offering them. If you have come across someone providing this type of loan assistance, validate the lending process carefully.

These loans should work like a usual short-term financing alternative. Any mismatch can be a red flag, and you must report it at once. Direct lenders will have a super-fast mode of application.

You do not have to spend too much time to fill out the application. Submitting the form is easy and requires a few clicks on the mouse. The overall procedure is not at all a time-consuming one.

The promptness of the application process is also because credit checks are not mandatory. Your income proof acts like a valid document to assure the lender like Myfinancialloans about the possibility of getting loan payments.

The loan provider is the right person to answer all your queries related to the application procedure.

Is avoiding these loans possible for anyone?

Yes, it is 100% possible, provided you want to handle your finances seriously. After all, you will borrow money in trivial amounts to meet some unforeseen need.

Having a budget plan can safeguard you from many such situations. Start formulating it if you are still not following one. Segregating monthly payouts and income becomes effortless.

You can get a perspective of what you can save by placing expenses against earnings. All this will be possible if you start budgeting without any further delay. This simple process has no complex logic behind it.

Anyone, even a small kid, can understand the simple structure of budgeting. The most significant advantage of it is that you know if your expenses are within your control. You will know if further costs are bearable for you or not.

Moreover, if you feel monthly expenditure is more than what you earn, you can also think of starting a side hustle. Additional income can provide you with extra money for unforeseen necessities.

This way, with the help of budgeting, you can do the needful to get your financial condition back on track. Above all, it does not even need to borrow money at a high cost.

Will loan price burn a hole in your pocket?

These loans are provided on short notice and for a comparatively smaller duration. For this reason, the rate of interest might remain on the higher side. Direct lenders will customise loan offers by taking note of your financial condition.

If you prefer having direct lending services, you can get loans at pocket-friendly rates. However, the best way to confirm affordable prices is by shopping around. In simpler terms, you just have to compare the rates of one lender with another.

This process will not cost you anything. You can do it on your own by using different types of online tools. You can stack offers from one lender against the other without putting in any additional effort.

Do not trust any lender blindly, even if they claim to offer attractive rates. Conduct careful research about the loan provider. Fraudsters are there to trick borrowers like you.

The easiest way is to review the lender’s website. There, you can easily find some feedback and deets of the physical address of the lender.

How to be cautious about handling payday loans?

Loans are, after all, debts, and you must get rid of them as early as possible. The more you will stretch repayment, the more interest you will have to compensate for.

Never leave the payment plan on the lender. Instead, you must negotiate and participate in the process. This way, you can obtain a relatively better price and opportunity from the loan provider.

Work overtime to get extra money apart from your salary. It will help you keep up with loan payments. Most importantly, you can pay off loan debts at the earliest.

Although these loans do not need any assets, this should not motivate you to delay loan payments further. Repaying on time is the key to maintaining financial equilibrium.

The bottom line

Payday loans can sort out different types of pending payments. Repayment is also hassle-free for these loans. Still, some facets are there that you must understand ahead of applying.